What is Mobile Collections from Esendex?

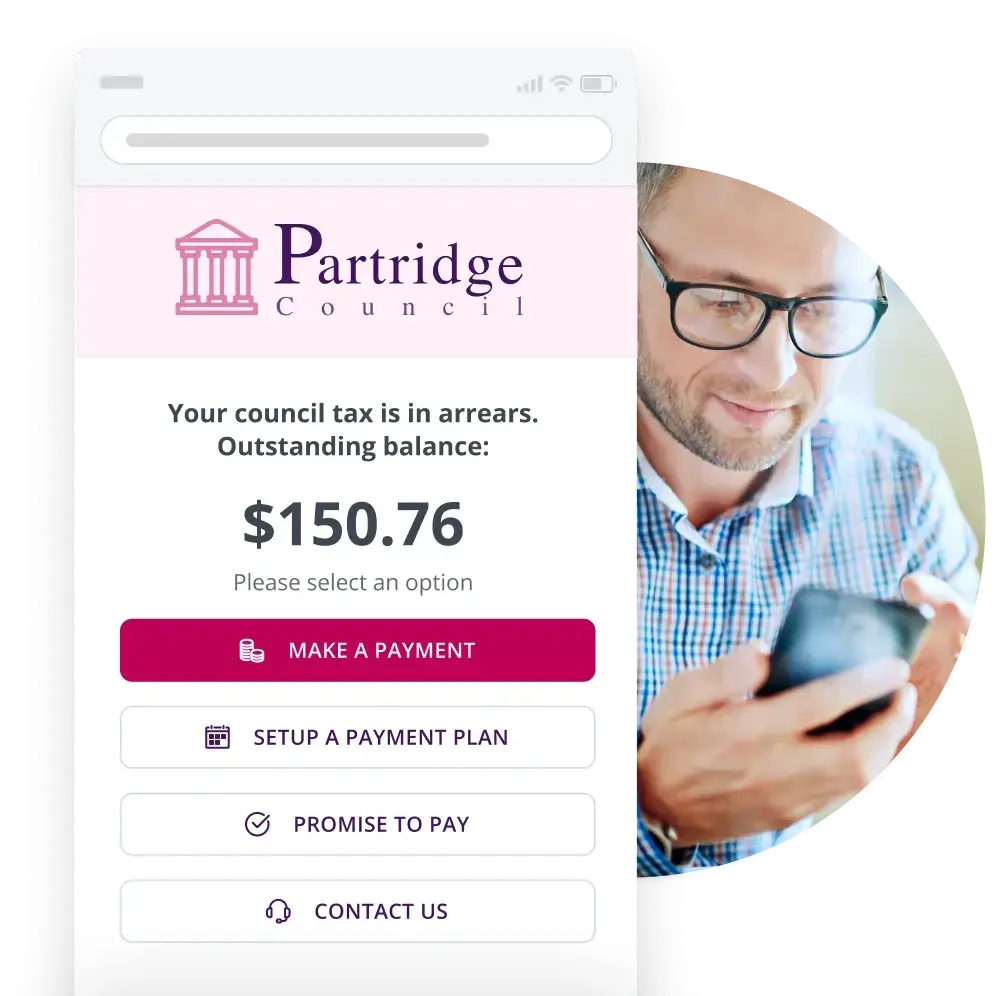

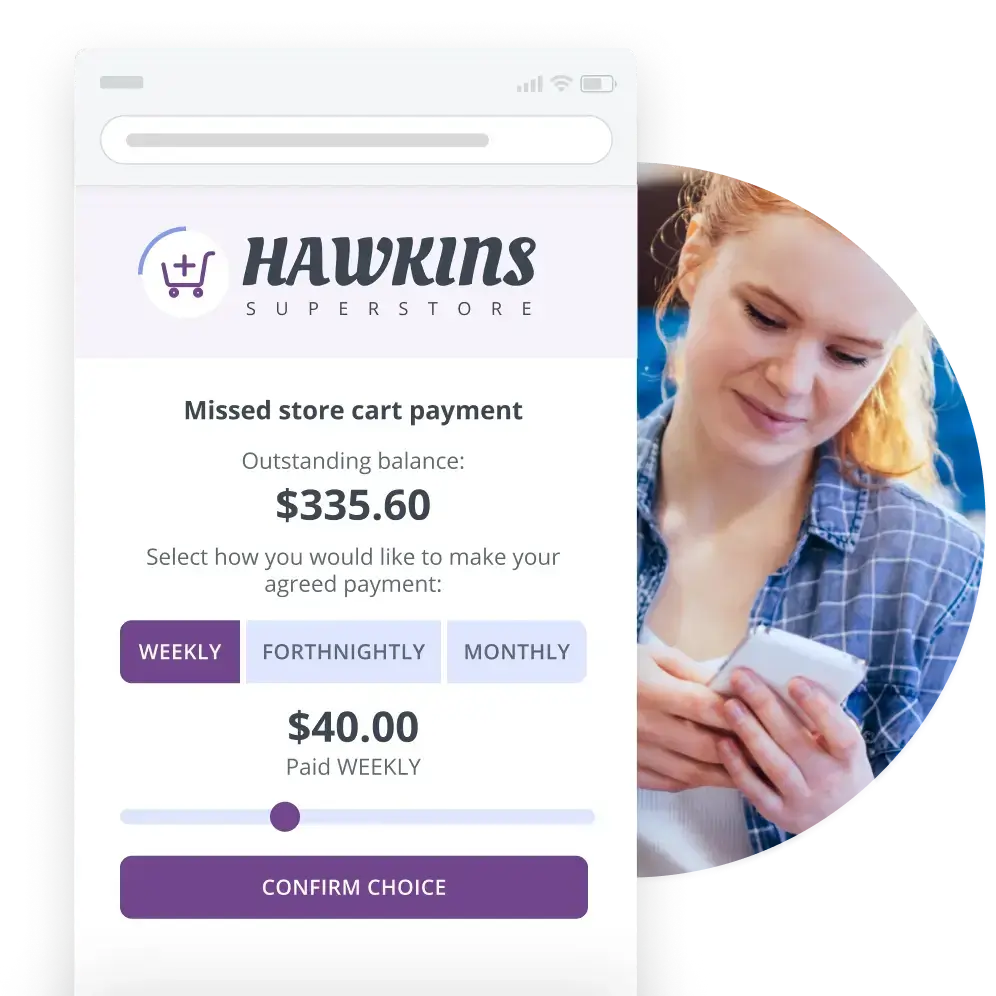

Mobile Collections from Esendex is a smart, automated SMS payment system that enables easy, secure payment collection via mobile. Through a single SMS or Email, your customers will be able to make payments and arrange repayment plans at their preferred time and place in a rich, branded and engaging environment. Customers can even choose to speak with an agent through their preferred channel if they need to chat.

Mobile Collections also allow you to fully automate your whole collection strategy by sending out reminders and notifications when payments are due, or when plans are not kept up to date.

All this allows your customers to self-serve, which in turn increases your collection rates and significantly lowers your cost to serve.

Who can use Mobile Collections?

Here are just some of the industries that can benefit from more intelligent ways to collect and arrange payments from customers.

In-house teams

Any organisation with a large customer base, each generating small value debt, will inevitably face resource challenges, given the cost of collecting this debt through in-house collections teams. Mobile Collect helps with this by providing an engaging and convenient “appless app”.

Our Mobile Collect payment method is intuitive and grows with your business needs – it is not a closed development. The platform allows for multiple identity verification steps, and a bespoke user interface for your end user to engage with. System integrations are also made simple as our Professional Services teams ensure our platform can “talk” with your CRM and PSPs in realtime.

Debt Collection Agencies

Debt collection agencies that have acquired large volumes of low-value debt face a big challenge in providing a great ROI, given the cost of using traditional communication methods.

Mobile Collections helps streamline debt collection and improve ROI by providing an engaging and convenient “appless app”, which not only allows users to pay by SMS or arrange a payment plan, but also requires no continual development and uses communication channels that are significantly cheaper than traditional methods.

Mobile Collections also provide a number of options for your customers to engage with you to discuss their situation and make a repayment arrangement, where they previously would have been forced to make an expensive phone call, giving your customers a better experience and reducing your cost to serve.

What are the benefits of Mobile Collections?

Implement with

speed and ease

Transition to your new Mobile Collections strategy by using your existing SMS payment provider.

Reduce

cost to serve

Reduce expensive paper communications and calls by allowing customers to self-serve.

Maximise

security

Validate customer’s identity by requesting security information as part of the payment request and collections process.

Completely

scalable

Our Professional Services team provide a managed platform making it easy to up/downscale campaign sizes.

Recoup

more debt

19% of customers made payments using Mobile Collections, compared with 4% via legacy systems.

Self-serve

facilities

Provide convenience to your customers, ensure timely payments and save staff resources by supplying intelligent self-serve facilities.

24/7

support

Payments can be taken around the clock, and not limited to when agents are available.

Non-intrusive

prompting

Debt repayment can be prompted in a more discrete way, which encourages more payments taken.

Who can use Mobile Collections?

Here are just some of the industries that can benefit from more intelligent ways to collect and arrange payments from customers.

Utilities

Mobile Collections offer a tailored approach to resolving this problem, by providing the tools to treat every customer uniquely and fairly depending on their circumstances, which in turn greatly improves the chances of them making a payment.

Local government

Mobile Collections give citizens more flexible ways to pay and could see fewer debts being incurred, a reduction in the stress and anxiety experienced by those with financial difficulties, a greater percentage of debts paid off, and councils spending less in the long run.

Retail

By using a mobile-focused collection strategy which is far more likely to reach the customer, retailers can not only stress the importance of the customer’s outstanding debt but also provide the convenient tools to make and plan payments.

Insurance

Few industry sectors will have to collect quite as many payments from customers as the insurance sector. While a large percentage of customers choose to make an annual payment, many choose the convenience of a monthly payment – but this, in turn, poses a problem for insurers. I.e. how to most effectively collect and arrange payments from those that miss a payment.

Mobile Collections provide a simple, engaging and cost-effective way for insurers to automate this collections process, while at the same time providers interactive payment scheduling tools which allow the customer to self-serve.

Motor finance

Inevitably, numbers this big will lead to many customers missing payments which would previously have been a massive undertaking to chase. Mobile Collections offer a completely automated way to collect these payments. By providing self-serve, flexible payment tools you’ll be increasing the chances of collecting more debt, and saving your in-house resource.

Personal loans

Mobile Collections provide a simple, engaging and cost-effective way for insurers to automate this collections process, while at the same time providers interactive payment scheduling tools which allow the customer to self-serve.

How will Mobile Collections help us recoup more debt?

Here are just some of the tools that will help your business collect more debt by automating processes.

Leading payment

provider integration

Your existing payment processor can be quickly and easily integrated into your new collections solution.

Personalised for

each customer

Use your customer’s name and unique account details for a more engaging journey.

Modular

solution architecture

Choose from a variety of customer payment options to include (E.g. make a payment, set up a repayment plan, promise to pay, etc).

Maintain your

corporate identity

Create a consistent experience for your customers by including all your logos, colours and imagery.

Measure

collection rates

Interrogate each customer collection journey, with simple to understand feedback and reports.

Use as part

of a multichannel strategy

Combine with SMS, Voice, Email and other web-based channels to maximise the recoupment potential of your campaign.

PCI DSS

compliant platform

Esendex will process credit card information securely.

Adaptive decision

engine

Collection strategies can adapt based on communication outcomes and customer interactions, facilitating a low-touch process.

Keen to know more? Read our Mobile Collections eBook

There has never been a better time for businesses to switch to a digital, self-serve collections strategy. When combining the range of solutions available, with an increasing customer appetite, businesses using traditional collection channels like post and manual calls should certainly be considering the switch, if they haven’t already.

Our new eBook (The Problem with Payments) explores the implications of not going digital, the options available, and how you can make your customers happier by providing a convenient, self-serve platform.

We’re integrated with all major payment merchants

Let’s start sending, together.

Thanks for submitting your enquiry. A member of our sales team will be in touch shortly.